Partner with Gordon Bizar to Acquire a Large Wealth-Creating Business with You owning the lion's share

An opportunity to have Gordon Bizar as your partner to acquire the business of your choice.

GET RESULTS!

- View THE OPPORTUNITY

- View QUALIFICATIONS

- View the APPLICATION PROCESS

- View PIBA FEES AND EQUITY PARTICIPATION

- Click on Application Download

THE OPPORTUNITY

What if you have Gordon Bizar as your partner and his team of top business professionals to help you land your first company… or series of companies? Or, if you already own your own business… to personally help you acquire suitable targets for roll-up or expansion?

Couldn’t you…

- Build your wealth, power, and income beyond your capabilities as they exist today

- Put yourself years, if not decades, ahead of going it alone

- Put an end to trying to figure out how to do everything yourself

- Enjoy the thrill of a shared victory

- Dramatically shorten your learning curve

- Reduce the likelihood of costly mistakes

- Greatly reduce your stress and headaches

- Control the acquired business to higher success with Gordon’s support

- Leverage yourself and your vision through the work and resources of Gordon’s team and his other highly qualified partners

- Know you’re taking the best path

- Benefit from personal coaching & mentoring by Gordon Bizar

- Virtually eliminate any overwhelm, paralysis, confusion or frustration you may have experienced in the past to buy or build your business.

Gordon and his team will help you…

- Target the right companies

- Recruit and build your dream management team

- Evaluate & price each acquisition

- Negotiate the deals

- Structure your acquisitions properly

- Form new vehicles to be the legal buying entity(s)

- Draft documents necessary for the governance of the buying entity(s)

- Put all the financing together

- Draft the mountain of documents and agreements these transactions require

- Efficiently and effectively execute the closing

- Acquire ownership and control of your competitors

- Roll up other companies into the acquired business

- Initiate Strategic Aggregation as a business model for annihilating the competition

- Greatly reduce the time, headaches and steep learning curve normally required to complete these sophisticated strategies and tasks

Three ways people might see you… which would you choose for yourself?

- Smartest person who ever lived

- More knowledgeable than anyone else ever

- Accomplished deeds that created great wealth and revolutionized humanity for the better

In life, your true measure is RESULTS! All one leaves behind is what they did. The highest enjoyments of life are in the doing it.

Rather than learn how to do everything necessary to buy a business… Get most everything you need to buy a business done hands-on with Gordon and his team!

PIBA is not about teaching people how to do everything needed to buy a business…

PIBA is about getting everything needed to buy a business done.

Special Note for C-Suite Executives

Benefits

- Reignite your career in a tough job market

- Create wealth versus just get a paycheck

- Enjoy business owner tax advantages

- Rise above company politics, come in at the top

- Gain control over your financial security

- Take control over your financial destiny

- Gain control over your personal time

- Shorten your learning curve

- Shorten your execution time

- Achieve a higher certainty of outcome

- Develop a long-term business growth support relationship

- Create your legacy, pass the business on to your children, or

- Cash out with family wealth that perpetuates through generations yet unborn

Post Close Benefits

Since Gordon and his team own a percentage of the company, here are some added post-acquisition growth support capabilities of the team:

- Marketing

- Purchasing

- Operating cost reduction

- Tax reduction

- Asset protection

- Scaling for growth

- Office automation & systemization

- Implementation of Strategic Aggregation

QUALIFICATION

We’re looking for the “right stuff.” We admit into Partners in Business Acquisition those who best meet qualifications proven in the past to accomplish our mutually desired results. Also part of the qualification review is that applicants are seeking acquisition targets that meet minimum sales and EBITDA requirements.

Ideal Candidate Qualification (Missing one or two will not disqualify you)

- Superior communication skills

- Able to articulate your vision and motivate others to follow you

- Passion for the target Industry

- Experience building at least one successful business as

- Owner, CEO, CFO, COO, growth specialist or consultant

- Or, person in authority leading and coordinating the efforts of other professionals

- Experience with both failure and success

- Willingness to work with our team as a team

- Clear vision of the result you seek or a specific business acquisition target

- Motivated & ready to take action

- Character

- Integrity, tenacity, resourcefulness, loyalty, resilience

- Time and effort commitment

- Minimum 10 hours per week at the beginning

- As much as it takes as we transition into the closing

- Tacit Agreement to

- Follow through on all assignments

- Be the Driving Force for

- Prospecting for sellers

- Building cosmic bond with sellers

- Quarterbacking appointments

- Fully apply yourself to the achievement of mutually agreed upon goals

- Technology literate

- Sense of urgency

- Satisfactory completion of the PIBA application process

- Execution of the PIBA Partnering Agreement

Target Requirements

- Minimum Annual Sales: $15,000,000

- Minimum Annual EBITDA: $2,000,000

Exception to Sales and EBITDA Minimums

- If Sales or EBITDA is below the minimum during the past 12 months

- Great reason for the deficiency which can be quickly fixed by our PIBA applicant

- Company is on a growth trajectory which will surpass the minimums within a year

- Company is part of a rollup or consolidation which when taken together with the buying company and/or the other consolidation companies in the pipeline will equal or exceed 175% of the minimums

- The PIBA applicant is part owner of the company and is buying out their partner(s) and annual sales are at least $8,000,000 and annual EBITDA is at least $1,200,000

Preference is given to applicants with target companies exceeding minimums by 200% or more.

APPLICATION PROCESS

The entire process takes about 10 business days from the day we receive your completed application.

Application processing (day 1), Preliminary Evaluation (days 2-3), Interview (day 4, 5 or 6), Final Evaluation (days 7-9), Acceptance (day 10).

Application

- Download the Application

- Complete the Application and submit it as an email attachment to PIBA@bizarfinancing.com

- Go to the PIBA Application Deposit Payment Form and submit your $500 fully refundable deposit

- Watch for your email receipt and confirmation that your application has been received (usually within 24 hours)

Preliminary Evaluation

- Your application will be reviewed by Gordon and his team

- If your application is not accepted, you will be notified by email and your deposit will be refunded to your credit card in-full usually within 5 business days of the receipt of your application and deposit

Interview

- If your application is accepted, an appointment date and time will be set for your online personal interview with Gordon Bizar via GoToMeeting. Interviews typically last about 45 minutes.

- You will receive email confirmation of your meeting directly from GoToMeeting as well as a reminder email from GoToMeeting the day before and an hour before your scheduled meeting time. The reminders will contain your meeting access link

- The allotted time is very short given the questions we will each have for each other. So, it is important that you be on time for your meeting

- During your interview with Gordon, you will be asked to further explain some of the answers on your Application as well as answer other questions giving Gordon insight into your qualifications

- Part of the interview will be devoted to determining the appropriate acquisition size for your target company

- Your interview will be recorded so that it may be reviewed by Gordon’s team and so that you may have a copy for your future reference

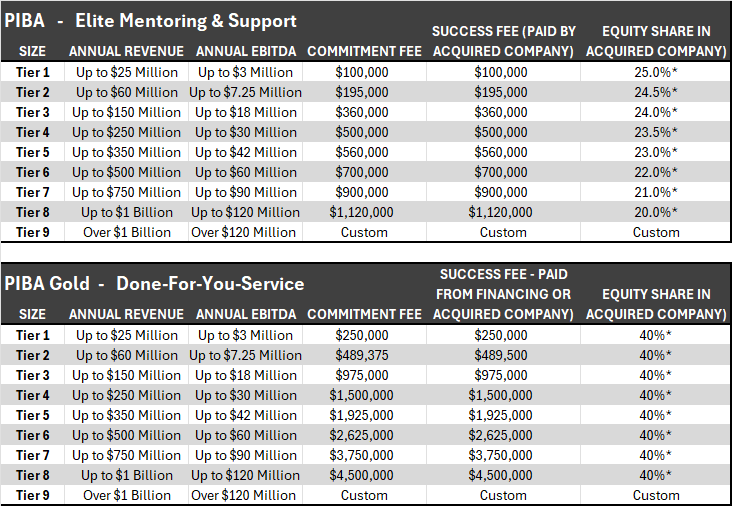

Choose between PIBA Elite Mentoring and PIBA Gold:

- PIBA Gold is an upgraded version of PIBA Elite Mentoring

- PIBA Elite Mentoring provides mentoring, coaching, and acquisition support, as described on this webpage

- PIBA Gold is a Done-for-You Service. We execute the entire business acquisition process on your behalf

- PIBA Gold assumes responsibility for initiating and completing the necessary tasks, subject to your approval

- The differences between PIBA Elite Mentoring and PIBA Gold are clearly indicated on this webpage

Final Evaluation

- Gordon and his team will conduct a series of evaluations culminating in a final decision on acceptance

- In rare instances, Gordon makes a phone call prior to a final decision to gain clarity through additional discussions with the applicant

Acceptance

- If your application is not accepted, you will be notified by email and your deposit will be refunded to your credit card in-full

- If you notify us at any time during the application process prior to your acceptance that you want to withdraw your application, your deposit is refunded to your credit card in-full

- If your application is accepted, your deposit will become non-refundable and applicable in-full to the Commitment Fee

- You will receive a Welcome Call from a PIBA team member to set up a schedule of personal recuring online meetings with Gordon to be sure that progress is monitored and maintained , all your questions are answered, and all your concerns are addressed.

- An email notice of acceptance is also sent

- You will receive an invoice from PIBA for the balance of the Commitment Fee along with wire instructions for payment

- Upon receipt of payment, your formal participation in PIBA begins

FEES AND EQUITY PARTICIPATION

The Commitment Fee is assessed according to the Revenue or EBITDA size of your target acquisition. If the EBITDA Size would produce a higher Commitment and Success Fees than would the Revenue Size, then the EBITDA Size is used to determine the Commitment Fee.

Often, surplus cash at or shortly after the close, is created as result of the structure and financing of the acquisition. That surplus cash is subject to distribution to the parties pro rata to their equity percentage.

Compensation to you from operations of the acquired business over and above an agreed upon base salary results in Consulting Fee compensation payable to Gordon and his designees in an amount pro rata to their ownership percentage of the business multiplied by amount of compensation to you over and above your base salary.

Reasons for Commitment Fee

Entrepreneurs instinctively want to conserve cash. So we are frequently asked if the Commitment Fee can be reduced, spread out over time, or waived. Respectfully we decline these requests. Experience has shown us that it has to be worthwhile for some extraordinarily successful people to give up other opportunities and put their time, talent, and resources behind you. Before investing in you, we need a demonstration of:

- Your Commitment

- Your Belief in Yourself

- Your Values & Priorities

- Your Resourcefulness

If you are not ready, willing, and able to invest in yourself, how can you ask others to invest 10’s of thousands of dollars of their time & resources to put you in business?

We also incur out-of-pocket expenses of supporting your progress that must be covered. In PIBA Elite Mentoring, any significant expenses that Gordon incurs in support of your acquisition, such as airline tickets or hotel stays, will be submitted to you for approval and payment before they are incurred. We cover minor or routine expenses, like phone calls, data charges, meals, and local mileage ourselves. In PIBA Gold, we manage all out-of-pocket expenses incurred by Gordon, his team, or necessary professionals to advance the acquisition. These expenses are reimbursed only after closing, and solely from the acquired company or any surplus capital raised.

One of the premier benefits of PIBA Gold is your cost of achieving a successful acquisition is fixed to the amount of your Commitment Fee.

Equity Participation

We make a commitment to provide you with a high level of personalized service, take the risk of success right along with you where our win is in our share of the equity split and cash distributions from the acquired company.

Equity Splits of the acquired company vary according the needs of each transaction and the resources required of Gordon and his team. The default split for PIBA Elite Mentoring is 80% to you or your designees and 20% to Gordon or his designees. The default split for PIBA Gold is 70% to you or your designees and 30% to Gordon or his designees. There are situations which provide for a different split but they are rare and tend to occur with acquisitions of businesses in a field that Gordon is actively making acquisitions to build companies that he already owns. This would usually come to light and be addressed as a part of the application process.

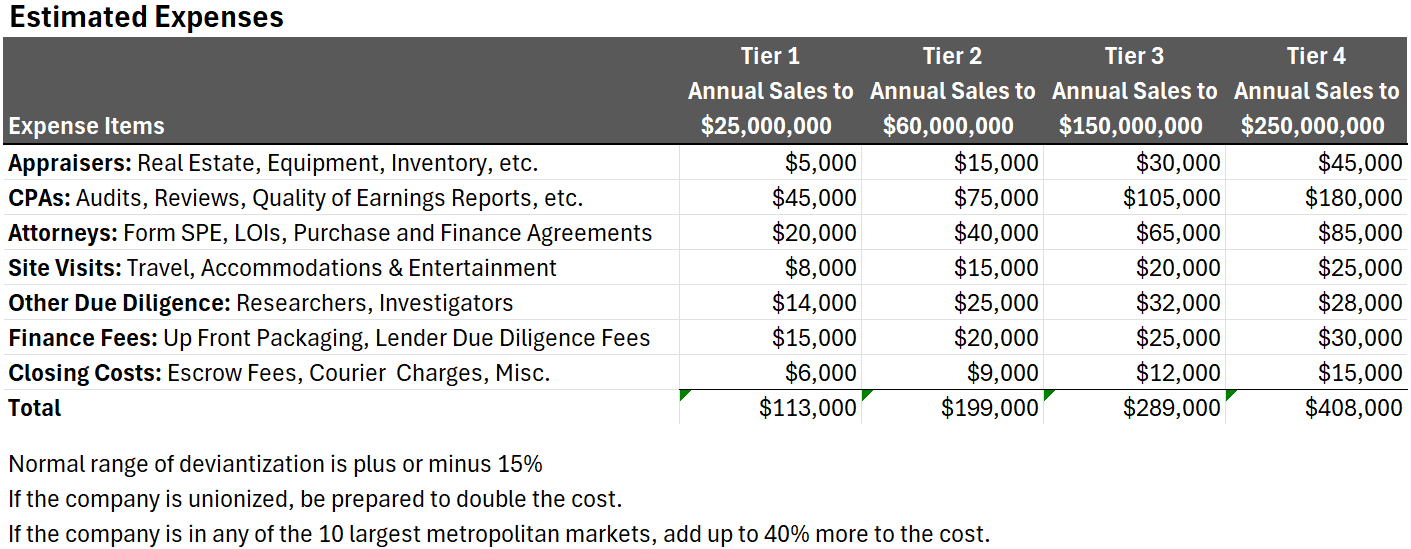

In determining your desire for and your commitment to the acquisition of your company, it is advised that you give careful thought to the total cash outlays that may be required. In PIBA Elite Mentoring, you will be responsible for paying them. In PIBA Gold, we will be paying them.

Typical Pre-Close Out-of-Pocket Expense for an Acquisition Based on Annual Sale Size

IMPORTANT CONSIDERATION: Some of our PIBA Elite Mentoring partners can handle these expense items with relative ease. For others, it may represent a great sacrifice. We are making you aware of these expense items in the table below so that you may consider them prior to submitting your Application and so you are prepared when they arise.

Many of these expenses can be negotiated lower, paid for all or in part out of the acquisition financing, paid for with equity in the buying entity in lieu of all or a portion of the fees, or covered by an investor. We recommend that you do not participate in PIBA Elite Mentoring unless you already have these funds available to you or you can see yourself handing them using one or more of these methods.

These expenses, to the extent they occur in PIBA Elite Mentoring, are the responsibility of the applicant.

Upon a successful closing, the above expense items remaining owed to the various service providers and any other closing cost will be paid from the acquisition financing. To the maximum extent possible, any of these expenses advanced by the applicant or by us prior to the close will be a priority for reimbursement either from the proceeds of the acquisition financing or from early positive cash flow developed from the acquired company.

Our Partnering Agreement Also Provide That Within the Scope of the Agreement:

- Neither Gordon Bizar, nor Bizar Financing, or National Diversified Funding Corporation is a cash investor

- Gordon and his team will apply their best efforts toward the successful acquisition of your target company

- All participating parties agree

- To keep all matters and information pertaining to the acquisition confidential and not to circumvent each other

- Not to undertake any action that would create any binding obligation or commitment of the other parties without that party’s express written consent to do so

- Not to represent to any third party in any manner that they have the authority to create any binding obligation or commitment of the other parties without that party’s express written consent to do so

- All intellectual property existing, modified, or newly developed relating to the acquisition or financing process is and shall be the sole property of National Diversified Funding Corporation

- Without compensation to you

- Bizar Financing may use your acquisition(s) as a case study for its training programs

- You agree to provide a detailed written testimonial which Bizar Financing may publish

- You agree to do a recorded audio and/or video interview with Gordon Bizar as part of a Bizar Financing training webinar discussing the challenges faced, the solutions used, and the results achieved which may be published

- By enrollment in PIBA, you are granting to Bizar Financing the right to use your name and likeness

Participation in PIBA means that all parties are making a major commitment to themselves and each other to pursue a set of mutually agreed upon goals culminating in the successful acquisition of a substantial business. If you are ready to undertake these commitments, here is the link to the APPLICATION.

Submission of your Application and/or your payment of the Commitment Fee constitutes your agreement to the terms and conditions of PIBA Elite Mentoring or PIBA Gold participation as stated above.